“A post COVID-19 world is not one you want to be wandering around in without a map…”

Author: Michael Brennan

We live in uncertain times. For businesses, these uncertain times mean that relying upon the past for predicting future outcomes becomes very difficult.

Even before COVID-19, banks were becoming much more demanding when examining the viability of businesses. Whilst historical performance has and will always be a strong indicator of future results, the reliance upon robust cash flow forecasting has increased.

Cash flow forecasts sometimes bear the same relationship to truth as some people’s resumes. Any granular accuracy is strictly coincidental and what you don’t see is more telling than what you do.

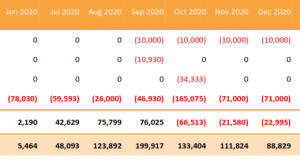

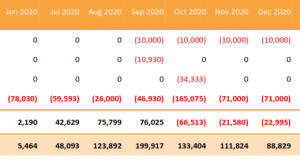

Businesses should be talking to their advisers and making strategic decisions with the benefit of three-way cash flow forecasts. These forecasts take a rigorous budget provided by the business and adapt that into a profit and loss and balance sheet projection for the period of the budget whilst at the same time identifying cash requirements as and when it will be needed to fund operations.

In essence, a three-way cash flow maps out the planned journey for the business and provides a picture of what the end result will be- the closest most accountants will ever come to writing a travel blog.

Business owners should not overlook the huge value from forecasting. The forecast itself can be used for a variety of stakeholders. Yes, you end up with a tested business plan and end result that you can judge your performance against, but more important is the process itself.

Drafting the projection should engage the owners in some deep reflection into how they’ll derive income into the future and what the expenses that are associated with that income production are. Further, it will give the owner the opportunity to identify cash shortfalls and surpluses that can be acted upon in stages as the journey progresses.

Sometimes the end result of the forecast is not a happy one. This too is a valuable tool for business owners and their advisers because it can show the financial consequences of trading decisions and reflect market conditions in a way that only numbers can.

From my experience, the single largest hurdle for business owners when faced with a cash constrained environment, is accepting that the situation is as bleak as it feels. Many professionals are critical of owners that express “hope” that their vision of the future will be better. Hope is dismissed as being a motherhood statement and an inadequate plan for success. Our role as professionals is to take that hope and shape it into a plan for success.

From my experience, the single largest hurdle for business owners when faced with a cash constrained environment, is accepting that the situation is as bleak as it feels. Many professionals are critical of owners that express “hope” that their vision of the future will be better. Hope is dismissed as being a motherhood statement and an inadequate plan for success. Our role as professionals is to take that hope and shape it into a plan for success.

Cash flow forecasting is not rocket science but requires honesty at all levels and the acceptance that without those plans the business may become lost on the journey. A post COVID-19 world is not one you want to be wandering around in without a map.